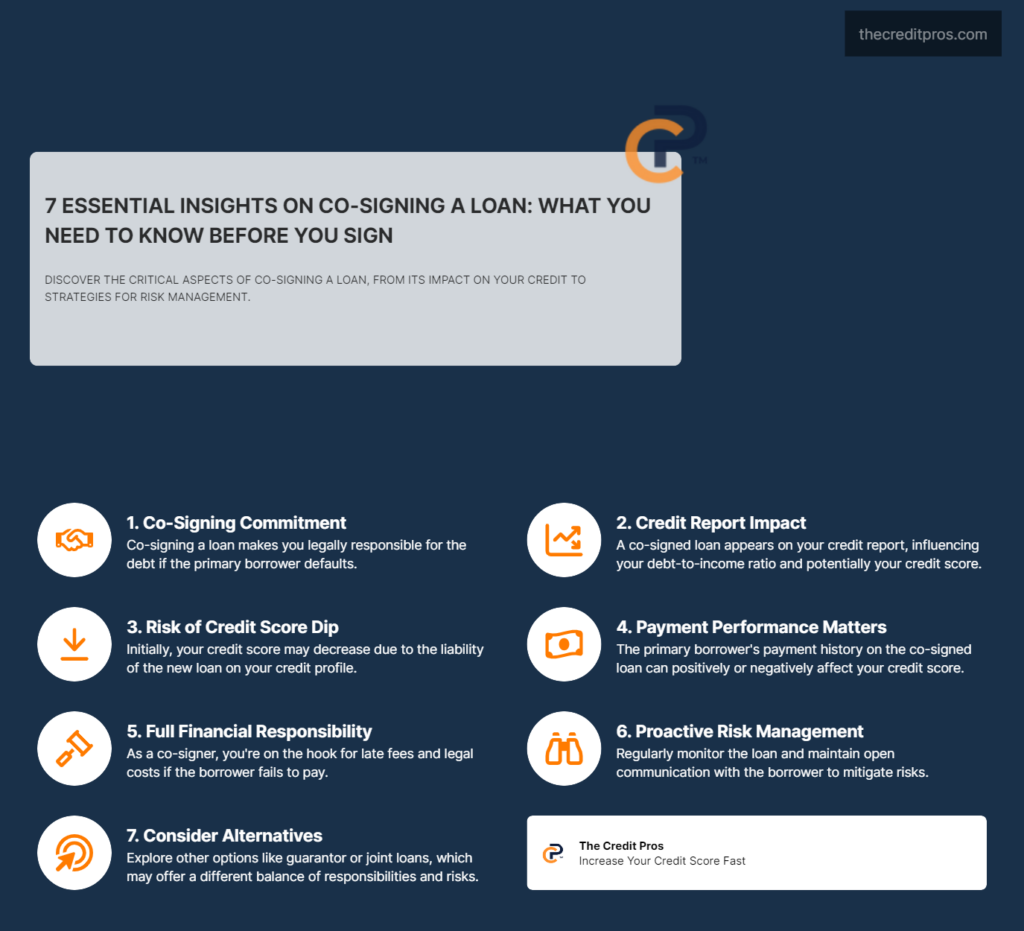

When you co-sign a loan, you’re lending your financial reputation and future credit potential. But what exactly does this mean for you and the primary borrower? This guide will explore the often overlooked nuances of co-signing a loan, from the immediate impact on your credit report to the long-term implications that could shape your financial health. Have you considered how a co-signed loan might appear on your credit report or influence your debt-to-income ratio? Understanding these factors is crucial, whether you’re helping a family member secure a mortgage or a close friend finance their education.

Co-signing a loan is a significant commitment that involves legal responsibilities and financial risks that can affect your credit score and overall financial stability. What happens if the primary borrower misses a payment, or worse, defaults? This guide will detail the responsibilities and risks associated with co-signing and discuss strategies to manage these risks effectively. By the end, you’ll be equipped with essential knowledge to make an informed decision about whether to co-sign a loan and how to protect your financial interests if you do.

1. The Basics of Co-Signing

What Does Co-Signing a Loan Mean?

Co-signing a loan means that you agree to be fully responsible for the loan if the primary borrower fails to make payments. This legal agreement is binding and shows up on your credit report as if the loan were originally yours. Understanding the distinction between a co-signer and a primary borrower is crucial. While the primary borrower is the individual who receives the funds and makes initial payments, the co-signer guarantees those payments, stepping in financially if necessary. This arrangement is often required by lenders when the primary borrower has insufficient credit history or low creditworthiness.

Common Types of Co-Signed Loans

Co-signing is common across various types of loans but is most prevalent in the contexts of car loans, mortgage loans, and student loans. Each type serves a specific purpose:

- Car Loans: Often co-signed by parents for their children or between spouses, helping to secure better interest rates and terms.

- Mortgage Loans: Co-signing can enable a borrower to qualify for a home loan that might otherwise be out of reach due to credit or income limitations.

- Student Loans: Given the high cost of education, parents or guardians frequently co-sign to support their child’s educational aspirations.

These scenarios underscore the necessity of co-signing in facilitating access to necessary funds under conditions where it might otherwise be denied.

2. Credit Impact of Co-Signing

Immediate Effects on a Co-Signer’s Credit

When you co-sign a loan, it appears on your credit report. This inclusion impacts your credit score primarily through the debt-to-income ratio, an essential factor in credit evaluations. Initially, your score may dip due to the increased perceived risk by creditors. The extent of impact varies depending on the existing credit health of the co-signer but is an important consideration before agreeing to co-sign.

Long-Term Credit Considerations

The long-term credit impact of co-signing a loan can vary:

- On-time Payments: If the primary borrower consistently makes payments on time, this can positively affect your credit score.

- Late Payments: Any delays or defaults in payments negatively impact your credit score. The longer the loan term, the longer your credit is susceptible to potential negative impacts from the primary borrower’s financial behavior.

Understanding these scenarios helps in assessing whether co-signing a loan aligns with your long-term financial goals.

3. Responsibilities and Risks

Understanding the Full Scope of Responsibilities

As a co-signer, your responsibilities extend beyond merely signing the loan agreement. You are legally accountable for the loan payments if the primary borrower defaults, which can include late fees, potential collection costs, and legal repercussions. It’s vital to fully understand these responsibilities and the possible need to make payments to protect your credit score.

Risk Mitigation Strategies

Effective risk management when co-signing a loan involves several proactive steps:

- Monitor the Loan: Regularly check the loan status and communicate with the lender to ensure payments are being made on time.

- Communication with the Primary Borrower: Establish clear communication channels with the borrower to discuss the loan status and any financial issues they might be facing.

These strategies can help mitigate risks and ensure that both parties maintain their financial health.

4. Alternatives to Co-Signing

Exploring Other Options

Before deciding to co-sign a long, consider these alternatives:

- Guarantor Loans: Similar to co-signing but often with a more limited obligation to the debt.

- Joint Loans: Both parties are equally responsible from the start, sharing the debt burden more equitably.

Each option has its benefits and drawbacks, and understanding these can guide your decision-making process.

When to Choose Co-Signing Over Alternatives

Choosing to co-sign should be based on a thorough risk-reward analysis. Consider these factors:

- Relationship with the Borrower: The closer your relationship, the more likely you might be to co-sign.

- Financial Stability: If both parties have stable financial histories, co-signing might be a viable option.

Assessing these elements helps in making an informed decision that aligns with both your financial and personal circumstances.

Conclusion: Navigating the Complexities of Co-Signing

Co-signing a loan is a significant financial decision that intertwines your credit fate with that of another person. It’s a commitment that can either bolster your credit score through on-time payments or jeopardize it if the primary borrower fails to meet their obligations. As we’ve explored, co-signing impacts your credit report immediately by adding to your debt-to-income ratio and potentially lowering your credit score due to the increased credit risk. Over time, the effects can be either beneficial or detrimental, depending on the primary borrower’s financial behavior.

Before you decide to co-sign, it’s crucial to weigh the responsibilities and risks involved. Effective communication with the primary borrower and regular monitoring of the loan can mitigate potential negative impacts. If co-signing seems too risky, alternatives like guarantor or joint loans might be worth considering. Ultimately, the decision to co-sign should be made with a clear understanding of both the immediate and long-term financial implications. Remember, when you co-sign, you’re not just lending your signature; you are lending your financial future. This decision should be grounded in financial prudence, not just trust.