Table of Contents

Understanding how student loan interest works is crucial for anyone aiming to manage their debt effectively. Many people are surprised by how much interest can add to the cost of their education, making it essential to grasp the basics of interest calculation. Why do some loans seem to grow faster than others? How does the choice between fixed and variable rates affect long-term payments? These are just a few of the questions this guide will address, providing clarity on a topic that often feels overwhelming.

As you navigate the world of student loans, knowing how to calculate and manage interest can significantly impact your financial planning. This guide breaks down the process into manageable steps, covering everything from the fundamental concepts of interest types to practical strategies for minimizing interest payments. You’ll discover how different loan terms can alter the way interest accumulates and learn about the potential benefits of refinancing. By the end, you’ll be equipped with the knowledge to make confident, informed decisions about your student loans.

The Basics of Student Loan Interest

Simple vs. Compound Interest

Understanding the difference between simple and compound student loan interest is crucial when managing student loans. Simple interest is calculated only on the principal amount of the loan, meaning you pay interest solely on the initial amount borrowed. This method is often used for federal student loans, providing a predictable and typically lower total interest cost over the life of the loan. In contrast, compound student loan interest accumulates on both the principal and any previously accrued interest. This can increase the total cost of a loan over time, as you’re effectively paying interest on top of interest. Some private student loans use this method, which can be more costly if not managed carefully.

The implications of compound interest are significant. Borrowers need to be aware that even if payments are deferred, the interest continues to accrue, potentially leading to a larger debt than initially expected. Understanding these differences helps in making informed decisions when choosing between federal and private student loans and strategizing repayment plans to minimize interest costs effectively.

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates, each affecting the loan’s total cost differently. Fixed interest rates remain constant throughout the life of the loan, offering stability and predictability in monthly payments. This is particularly beneficial for borrowers who prefer a consistent repayment schedule without the risk of sudden increases in their monthly financial obligations.

On the other hand, variable student loan interest rates fluctuate based on market conditions. These rates can start lower than fixed rates, potentially offering initial savings. However, they also carry the risk of increasing over time, which can lead to higher monthly payments and total interest costs. Borrowers considering variable-rate loans should assess their financial stability and risk tolerance, as unexpected rate hikes could strain their budgets.

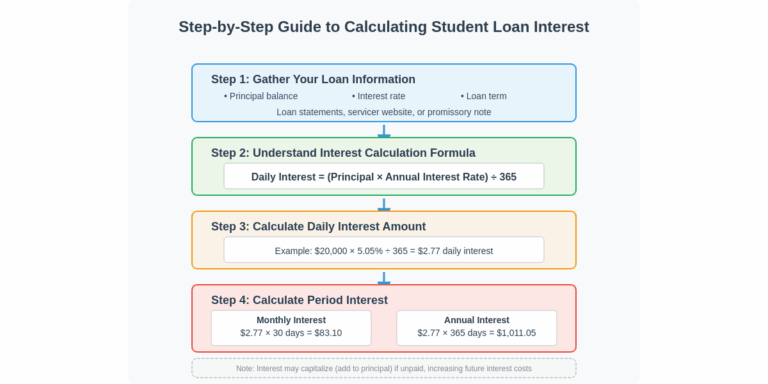

Step-by-Step Calculation Process

Determining Your Daily Interest Rate

Calculating your daily interest rate is a fundamental step in managing student loans effectively. The process begins with converting your annual interest rate into a daily rate. This is achieved by dividing the annual rate by the number of days in a year, typically 365. For example, if your annual interest rate is 5%, the daily rate would be approximately 0.0137%. This daily rate serves as the foundation for further calculations, helping borrowers understand how much interest accrues each day.

This calculation is critical because it allows you to see the daily impact of your loan’s interest, aiding in planning and budgeting. By understanding the daily cost of borrowing, you can make informed decisions about repayment strategies, such as making extra payments to reduce the principal and, consequently, the daily interest accrual.

Calculating Daily and Monthly Interest Accrual

Once the daily interest rate is determined, the next step is to calculate the daily interest accrual. Multiply the daily interest rate by the outstanding principal balance to find the amount of interest accrued each day. For example, with a loan balance of $20,000 and a daily interest rate of 0.0137%, the daily interest accrual would be approximately $2.74.

To calculate the monthly interest, multiply the daily accrual by the number of days in your billing cycle, typically 30. Continuing with the previous example, the monthly interest would amount to around $82.20. This calculation is essential for understanding the cost of carrying the loan each month, enabling borrowers to manage their finances more effectively and potentially make additional payments to reduce interest costs.

Factors Influencing Interest Accumulation

Impact of Loan Terms and Conditions

Loan terms and conditions play a significant role in how student loan interest accumulates. Features such as grace periods, deferments, and forbearances can affect interest accrual differently. During a grace period, borrowers are often not required to make payments, but interest may still accrue, particularly on unsubsidized loans. Deferments can offer temporary relief from payments, but interest typically continues to build unless the loan is subsidized.

Capitalization is another critical factor, where unpaid interest is added to the principal balance, increasing the total amount owed. This can occur after deferment or forbearance periods and can significantly impact the overall cost of the loan. Understanding these terms and how they influence interest accumulation is crucial for effective debt management.

- Grace Periods: Time when payments aren’t required, but interest might still accrue.

- Capitalization: Unpaid interest added to the principal, increasing the total amount owed.

Loan Amortization and Its Effects

Loan amortization refers to how payments are applied over the life of the loan, affecting the distribution between interest and principal. Initially, a larger portion of payments goes toward interest, with the principal being reduced more slowly. Over time, as the principal decreases, a greater share of payments reduces the principal balance, thus lowering the interest cost.

Amortization schedules provide a clear picture of how each payment impacts the loan balance, helping borrowers plan and manage their finances strategically. Understanding this process allows borrowers to explore options such as making additional payments directly toward the principal, which can accelerate repayment and reduce total student loan interest costs.

Strategies to Minimize Interest Payments

Early Repayment and Extra Payments

One of the most effective strategies to minimize interest payments on student loans is to make early and extra payments. By paying more than the required monthly amount, borrowers can reduce the principal balance faster, which in turn decreases the amount of interest that accrues. This strategy can significantly shorten the loan’s lifespan and reduce the total interest paid over time.

Implementing this approach requires careful budgeting and financial planning. Borrowers should consider applying any extra funds, such as tax refunds or bonuses, directly to their loan principal. Additionally, setting up automatic payments can help ensure consistent extra payments, leading to substantial savings in student loan interest over the loan’s duration.

Refinancing Options for Better Rates

Refinancing student loans can be a viable option for securing lower interest rates, leading to significant savings. By refinancing, borrowers can consolidate multiple loans into a single loan with a new interest rate, potentially reducing monthly payments and the overall cost of the loan. This option is particularly beneficial for those with high-interest private loans or improved credit scores since taking out the original loans.

Before refinancing, borrowers should weigh the benefits against potential downsides, such as losing federal loan protections like income-driven repayment plans and forgiveness programs. It is essential to shop around for the best rates and terms, considering both fixed and variable options, to ensure the most favorable student loan interest outcome.

Conclusion: Navigating the Complexity of Student Loan Interest

Mastering the intricacies of student loan interest is crucial for effective financial management. We’ve explored the difference between simple and compound interest and how fixed and variable rates can shape your repayment journey. Understanding daily and monthly interest calculations, along with the impact of loan terms, helps demystify the process and provides clarity. By embracing strategies like early repayment and refinancing, borrowers can significantly reduce their interest burden.

The insights gained here empower you to make informed decisions about your student loans, aligning with the themes of informed financial planning and strategic student loan interest management. As you move forward, remember that proactive engagement with your loans isn’t about numbers alone—it’s about shaping your financial future. Consider this: every decision you make regarding your student loan interest is a step toward financial independence, and the path you choose will define your long-term financial health.