Table of Contents

Predatory lending is a term that often raises concerns, especially for those who have faced its harsh realities. Many consumers find themselves trapped in loans that seem almost impossible to escape. But what exactly makes a loan predatory, and how can predatory lending laws protect you from falling into such traps? Understanding these practices is crucial, as they can significantly impact your financial well-being.

Legal protections are vital in safeguarding consumers from unfair loan practices, offering a safety net that many may not even realize exists. Some laws are well-known, while others work quietly in the background to ensure that lenders play by the rules. How effective are these laws, and what specific measures are in place to protect you? By exploring these questions, you’ll gain a clearer picture of how these regulations function and how you can utilize them to maintain a healthy credit profile.

Understanding Predatory Lending Practices

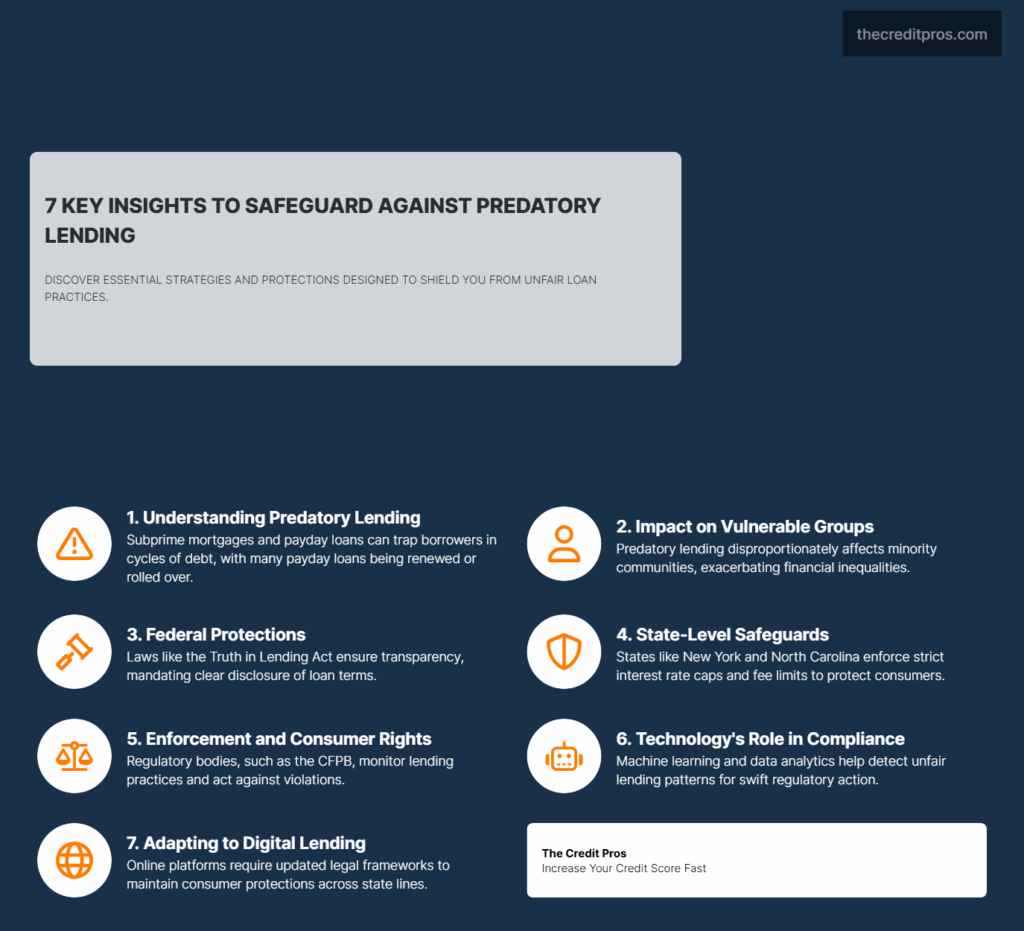

Predatory lending practices remain a significant concern for consumer advocates and policymakers. Subprime mortgages, typically offered to individuals with less-than-ideal credit scores, often involve higher interest rates and fees, reflecting the increased risk for lenders. While these loans provide access for those who might not qualify for traditional loans, they can lead borrowers into cycles of debt. The subprime mortgage crisis of 2008 exemplifies the severe impact these loans can have on both individuals and the economy.

Payday and car title loans further illustrate the challenges of predatory lending. These short-term, high-interest loans are designed for quick cash needs but come at a steep cost, with APRs often reaching triple digits. Many borrowers struggle to repay on time, leading to rollovers and additional fees, creating a challenging cycle of debt. The Consumer Financial Protection Bureau reports that a significant majority of payday loans are renewed or rolled over, highlighting the unsustainable nature of these financial products.

Predatory lending disproportionately affects minority groups and other vulnerable populations. Historical discrimination in lending has left many minority communities with limited access to traditional financial services, making them prime targets for predatory lenders. These groups often face higher interest rates and less favorable loan terms, exacerbating existing financial inequalities. Addressing these disparities is crucial to ensure fair lending practices for all consumers.

Key Predatory Lending Laws and Regulations

Predatory lending laws are structured by both federal and state legislation, each playing a crucial role in consumer protection. Federal laws like the Truth in Lending Act (TILA) and the Dodd-Frank Act provide a foundational framework for transparency and accountability in lending practices. TILA mandates clear disclosure of loan terms, while the Dodd-Frank Act established the CFPB to oversee and enforce consumer protection laws.

State legislation complements federal laws by addressing specific local concerns and closing gaps in federal regulations. States such as New York and North Carolina have enacted robust anti-predatory lending laws with strict interest rate caps and fee limits. These state laws can be more stringent than federal regulations, reflecting the unique challenges faced by residents.

The legal framework surrounding predatory lending has evolved significantly, particularly in response to the 2008 financial crisis, with new regulations introduced to curb abusive lending practices and enhance consumer protections. This evolution highlights the necessity for comprehensive legal measures to adapt to changing financial landscapes.

How Laws Protect Consumers

Predatory lending laws protect consumers through interest rate caps and fee limits, preventing lenders from imposing exorbitant charges that can lead to cycles of debt. By capping interest rates and restricting fees, these laws help ensure that loan terms remain fair and manageable, reducing the risk of financial exploitation.

Transparency and disclosure requirements are also essential components of consumer protection laws. These regulations mandate that lenders clearly outline loan terms, interest rates, and fees, allowing borrowers to make informed decisions. By ensuring access to all relevant information, these laws empower consumers to compare different loan options effectively.

Enforcement of consumer rights is vital in maintaining the integrity of predatory lending laws. Regulatory bodies like the CFPB play a key role in monitoring lending practices and taking action against violators. Consumers can leverage these laws by filing complaints and seeking legal recourse in cases of unfair practices.

The Role of Technology and Fintech in Enforcement

The rise of online lending platforms presents new challenges for enforcing traditional predatory lending laws. Digital lenders can operate across state lines, complicating jurisdictional enforcement and allowing some to exploit regulatory loopholes. With the rapid growth of fintech, ensuring compliance with existing laws requires innovative approaches and enhanced collaboration between regulators.

Technological advances offer new tools for detecting and preventing predatory practices. Machine learning algorithms and data analytics can identify patterns indicative of unfair lending, enabling regulators to act swiftly. Additionally, digital platforms can facilitate the collection and analysis of consumer complaints, helping regulatory agencies identify areas of concern and prioritize enforcement efforts more effectively.

As technology continues to reshape the financial landscape, adapting legal frameworks to address the unique challenges posed by digital lending will be crucial to maintaining robust consumer safeguards.

Wrapping Up: The Shield Against Predatory Lending

Predatory lending laws provide essential protection for consumers against unfair loan practices. By implementing interest rate caps, fee limits, and transparency requirements, these laws aim to prevent debt cycles that can harm financial well-being. Federal and state regulations collaborate to address both broad and localized concerns, ensuring fair lending practices.

As technology reshapes financial services, legal frameworks must adapt to maintain strong consumer safeguards. Knowing your rights and available protections is crucial for navigating the complex world of lending. Remember, addressing predatory lending involves ensuring equity and fairness in financial opportunities. Reflect on these insights as you consider how to strengthen your financial journey, aware of the high stakes and significant consequences involved.