Table of Contents

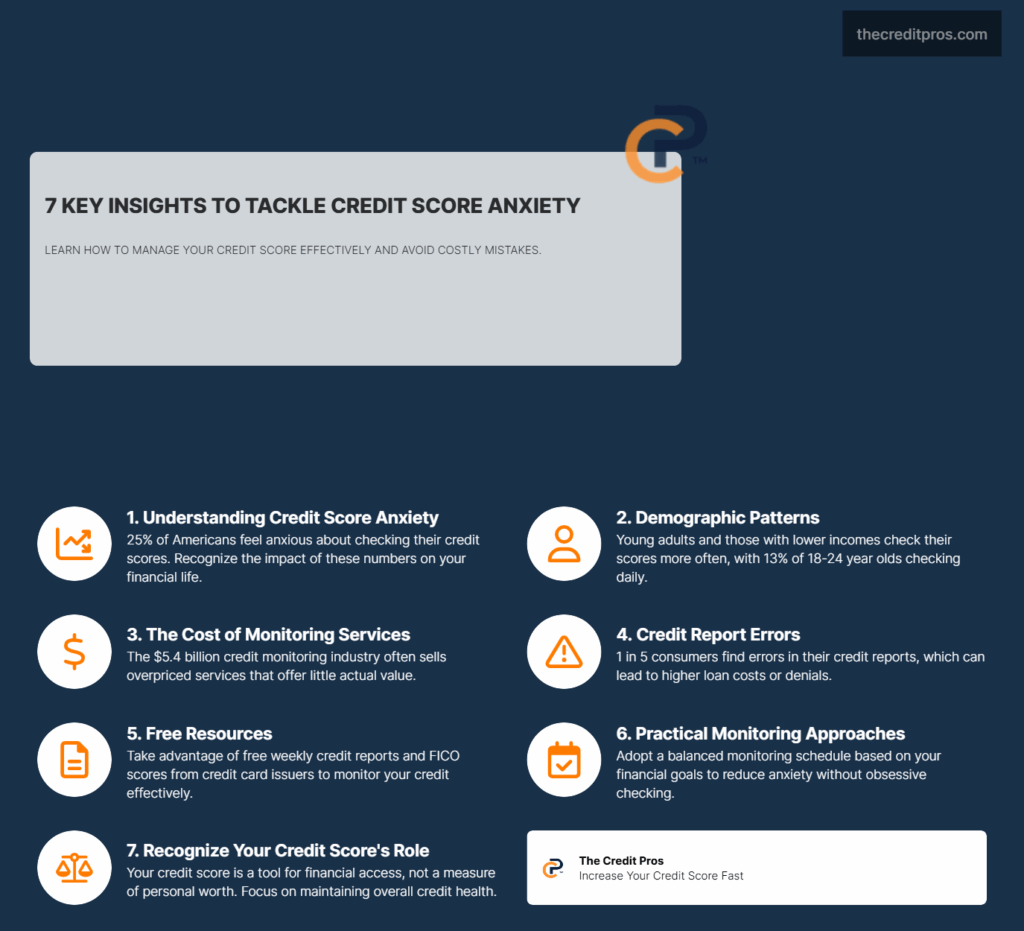

That small three-digit number on your credit report can trigger more anxiety than a horror movie jump scare. For 25% of Americans planning to apply for credit in the next six months, just thinking about checking their score creates an immediate sinking feeling. The credit anxiety isn’t unfounded – credit scores now impact everything from mortgage rates to job opportunities, with errors potentially costing thousands in higher interest rates or outright loan denials.

What’s particularly concerning is how credit anxiety has been weaponized by an industry worth $5.4 billion annually. Those who report managing money poorly check their scores most frequently – 11% check daily compared to just 4–5% of good money managers. Why do we obsess over these numbers? And more importantly, how can you protect yourself from both legitimate credit report errors and expensive “solutions” that prey on your anxiety? The truth about credit monitoring might surprise you.

The Anatomy of Credit Score Anxiety

Credit score anxiety or credit anxiety has become increasingly prevalent in American society, with distinct patterns emerging across different demographic groups. According to CivicScience survey data, younger Americans, those with lower incomes, and individuals from racial or ethnic minorities demonstrate significantly higher vigilance about their credit scores. Among 18-24 year olds, 13% check their scores daily compared to just 2% of those over 55. This hypervigilance represents a deeper psychological relationship with what many perceive as their financial identity.

The evolution of credit scores from simple lending metrics to all-encompassing financial report cards has fundamentally altered our relationship with these three-digit numbers. What began as tools for lenders to assess risk have transformed into gatekeepers for fundamental life necessities. Today’s credit scores determine not just loan approvals but rental housing access, employment opportunities, insurance premiums, and even utility deposits. This expansion of influence has created what financial psychologists describe as “credit anxiety”—the persistent worry that one’s financial future hangs precariously on a mysterious algorithm.

Perhaps most revealing is the paradoxical relationship between financial management skills and monitoring frequency. CivicScience data shows that individuals who self-report managing money poorly are more than twice as likely to check their credit scores daily (11%) compared to those who manage their finances well (4–5%). This compulsive checking behavior mirrors anxiety disorders where the very act of seeking reassurance actually reinforces and intensifies the underlying credit anxiety. For many Americans, especially those preparing for major financial decisions, credit scores have become a source of constant stress rather than a helpful financial tool.

When Monitoring Becomes an Expensive Obsession

The credit monitoring industry has masterfully capitalized on credit anxiety, growing into a $5.4 billion annual business according to IBISWorld. This industry thrives not just on legitimate concerns about identity theft, but on manufacturing a sense of perpetual vulnerability. Credit bureaus like Experian have developed sophisticated marketing funnels designed to convert free users into paying subscribers through escalating fear tactics. After creating a basic account, users are bombarded with near-daily emails ranging from benign score updates to alarming warnings about potential data breaches—all conveniently resolved by upgrading to premium services.

These premium services often come with substantial price tags that rarely deliver proportionate value. Experian’s CreditWorks Premium, for example, charges $25 monthly for quarterly credit reports and monitoring services—many of which consumers can access for free elsewhere. The National Consumer Law Center’s 2022 brief described these bundles as “expensive and ineffective,” noting they frequently fail to catch the most common forms of identity theft. While marketed as solutions to credit anxiety, most monitoring services focus on alerting consumers to newly opened accounts, while the NCLC notes that most identity theft actually occurs within existing accounts, making these expensive services fundamentally misaligned with actual risks.

The Government Accountability Office’s assessment of the industry is equally concerning. Their 2017 report questioned the effectiveness of both monitoring and identity theft protection services, highlighting that even the identity theft insurance included in these packages typically excludes actual financial losses. Instead, they primarily cover expenses related to the cleanup process after theft has already occurred. Chi Chi Wu, senior attorney at the National Consumer Law Center, puts it bluntly: “There’s no reason ever to pay for credit monitoring. There’s no reason to pay for a credit score or pay for service for the credit score.” Yet the industry continues to grow by exploiting the gap between perceived and actual value in an environment where consumers feel increasingly vulnerable.

“The credit-scoring companies have figured out how to profit on the anxiety of consumers with credit watch and credit monitoring and all of these add-on programs. When companies find a way to profit off of anxiety, they have an incentive to create anxiety.” – Aaron Klein, senior fellow in economic studies at the Brookings Institution

Inaccuracies: When Your Credit Report Horror Story Is Real

Credit report inaccuracies represent a legitimate foundation for credit anxiety, with studies consistently showing alarming error rates. A Federal Trade Commission study found that one in five consumers had a verified error on at least one of their three credit reports, with 5% having errors serious enough to result in higher-priced loans or insurance. These errors can cost consumers thousands of dollars over the life of a mortgage or auto loan, or result in outright denials for critical financial products.

The process of disputing these errors presents its own set of challenges. While consumers have the legal right to dispute inaccuracies directly with credit bureaus at no cost, the system is often frustratingly opaque. Credit anxiety can intensify during this process, as credit bureaus are required by law to investigate disputes within 30 days, but their investigation process frequently consists of simply verifying the information with the original furnisher—the same entity that provided the incorrect information in the first place. This circular verification process can leave consumers trapped in a bureaucratic nightmare, especially when dealing with complex issues like mixed files (where information from another consumer is mistakenly included in your report) or identity theft aftermath.

This landscape of legitimate concerns creates fertile ground for credit repair companies that promise quick fixes for damaged credit. These operations, which often target financially vulnerable populations, typically charge substantial upfront fees ranging from hundreds to thousands of dollars. Their standard approach involves disputing every negative item on a credit report regardless of accuracy—a practice that may temporarily improve scores while items are under investigation but ultimately results in most negative information returning to the report once verified. Sarah Chenven, CEO of Working Credit, a nonprofit that helps people build credit, explains the predatory nature of these services: “They’re basically charging people with the false promise that they’re going to be able to fix their credit reports and credit scores permanently when they can’t.” The CFPB has taken action against numerous credit repair operations, including a $2.7 billion settlement last year with companies accused of illegally collecting fees for their services.

- Common credit report errors to watch for:

- Accounts belonging to someone with a similar name

- Duplicate accounts reporting the same debt twice

- Closed accounts incorrectly shown as open

- Incorrect payment status or balance information

- Outdated negative information beyond reporting time limits

- Accounts incorrectly reported as late or delinquent

- Incorrect hard inquiries damaging your score

Breaking the Cycle: Practical Approaches to Credit Monitoring

Developing a balanced approach to credit monitoring begins with understanding what services are actually necessary versus those designed primarily to generate revenue. Under federal law, consumers are entitled to one free credit report annually from each of the three major bureaus (Experian, TransUnion, and Equifax) through AnnualCreditReport.com. Since the pandemic, this access has been expanded to weekly free reports—a benefit many consumers remain unaware of. Additionally, most major credit card issuers now provide free FICO score access, helping to reduce credit anxiety by offering regular insights without the need for paid monitoring services.

For those concerned about identity theft, a credit freeze represents one of the most effective preventative measures—and it’s completely free. Unlike paid “locking” services that charge monthly fees, a security freeze prevents creditors from accessing your credit report without your explicit permission, effectively blocking the opening of new accounts in your name. Implementing a freeze requires contacting each bureau individually, but the process has been streamlined in recent years. When you need to apply for credit, you can temporarily lift the freeze (also free) for a specific period or for a particular creditor. For those experiencing credit anxiety, this approach offers significantly better protection than most monitoring services—at no cost.

Creating an effective monitoring schedule based on your financial goals represents another key strategy for reducing credit anxiety while maintaining vigilance. For most consumers, checking scores and reports quarterly provides sufficient oversight without feeding into obsessive monitoring behaviors. However, this schedule should be adjusted during periods of significant financial activity. When preparing for a mortgage application, for example, more frequent monitoring (perhaps monthly) for 6–12 months before applying allows time to address any issues that might affect approval or rates. After major credit applications or during identity theft recovery, temporarily increasing check frequency may also be warranted. The key is establishing a routine that provides necessary information without reinforcing credit anxiety through compulsive checking.

“If you have a credit score over 720 or 780, stop worrying. Don’t be obsessed with getting an 800 or 820,” advises Chi Chi Wu from the National Consumer Law Center. “This is not your SAT score.” This perspective helps reframe credit monitoring as a practical financial maintenance task rather than an emotional barometer of personal worth. For those experiencing significant credit issues, nonprofit credit counseling organizations offer expert guidance at little or no cost, providing a valuable alternative to expensive credit repair services. Organizations certified by the National Foundation for Credit Counseling or the Financial Counseling Association of America adhere to strict standards and can provide personalized advice for addressing legitimate credit concerns.

Understanding the difference between various credit score models also helps demystify the monitoring process. Many free score providers use educational or “FAKO” scores that may differ significantly from the FICO scores most lenders use. These variations don’t necessarily indicate problems—they simply reflect different scoring methodologies. What matters more than the specific number is the overall range (excellent, good, fair, poor) and the factors influencing your score. Focusing on these elements rather than minor score fluctuations helps maintain perspective and reduces unnecessary credit anxiety about normal score variations.

Frederick Wherry, a Princeton sociologist who leads the Debt Collection Lab, explains the psychological impact of credit scores: “As soon as we are asked about our credit scores, or in a moment when we can’t get something we need or we get it at too high a price, that’s when we realize that this thing has been hanging over our heads.” This realization often triggers the anxiety that credit monitoring services exploit, but with proper education and a balanced approach, consumers can maintain healthy credit vigilance without falling prey to expensive and unnecessary services.

Final Thoughts: Taking Control of Your Credit Story

Credit scores have evolved from simple lending metrics into all-encompassing financial gatekeepers, creating legitimate credit anxiety for millions of Americans. While the $5.4 billion monitoring industry profits from this fear, the reality is that most consumers don’t need expensive services to maintain healthy credit. Free weekly credit reports, complimentary FICO scores from credit card issuers, and free security freezes provide more effective protection than premium monitoring packages that often fail to catch common forms of identity theft. Understanding the true nature of credit reporting errors—affecting one in five consumers—allows you to address legitimate credit anxiety without falling prey to expensive “solutions” that primarily benefit the credit bureaus themselves.

Your relationship with your credit score doesn’t have to feel like a horror movie. By establishing a balanced monitoring schedule based on your financial goals, focusing on overall credit health rather than obsessing over minor fluctuations, and utilizing free resources, you can transform credit anxiety into informed confidence. Remember that your credit score is a tool to help you access financial opportunities—not a measure of your personal worth or character. Perhaps the most powerful step in breaking free from credit anxiety isn’t checking your score more frequently, but recognizing when the fear itself has become more damaging than what you’re afraid of.