Credit Score Recovery: Bouncing Back from Financial Setbacks

Credit Score Recovery helps you bounce back from financial setbacks with strategies to rebuild and improve your credit score quickly and effectively.

Latest Posts

Credit Score Recovery helps you bounce back from financial setbacks with strategies to rebuild and improve your credit score quickly and effectively.

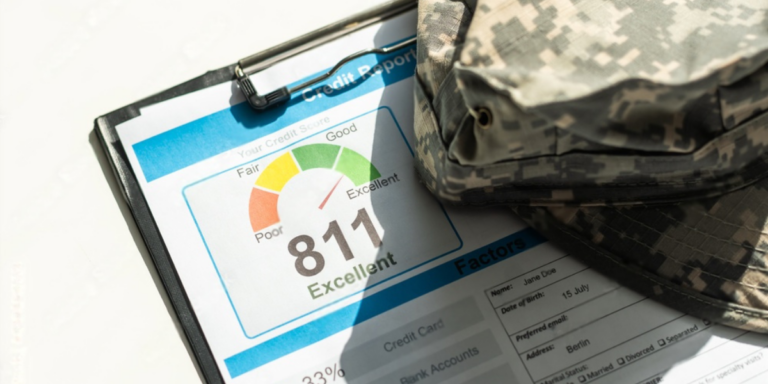

Learn how bad credit affects military security clearance and discover steps to improve your financial health and maintain eligibility for clearance.

Discover how to optimize your credit score for first-time home buyers. Learn key strategies for improving your score to secure the best mortgage rates.

Explore Credit Repair vs. Credit Building to understand how each approach affects your credit score and overall financial health in this informative guide.

Wondering Is Credit Repair Legit? Explore how it works, its pros and cons, and if it’s a valid way to improve your credit score in this comprehensive guide.

Develop a credit score fitness plan with actionable steps to boost your financial health, improve your score, and achieve long-term financial success.

Identity theft is distressing, impacting credit score & financial health. Recognize signs early, take action, repair credit to bounce back.

Maintaining good financial habits is the cornerstone of rebuilding your credit score. It’s essential to create a budget, track your expenses, and live within your means.

When it comes to securing a home loan, your credit score is a threshold for eligibility. Borrowers with scores in the range of 500 to 620 may find it possible to obtain a mortgage, although the options may be limited.

When a payment is missed, it’s not just the immediate fees and penalties that are of concern. A late payment can lead to a significant drop in your credit score, potentially by up to 180 points.

Debt settlement is an agreement between a debtor and a creditor where the debtor pays a lump sum that is less than the full amount owed to close out a debt. While this option may seem appealing, it’s important to recognize the potential repercussions.

The Benefits of Having A High Credit Score include better loan terms, lower interest rates, easier approvals, and increased financial opportunities.

Your privacy matters! We only uses this info to send content and updates. You may unsubscribe anytime.

It only takes 90 seconds to sign up. Start fixing errors on your credit report and get help to increase your credit score. Your information is safe with us. We treat your data as if it were our own.

Privacy and Cookies

We use cookies on our website. Your interactions and personal data may be collected on our websites by us and our partners in accordance with our Privacy Policy and Terms & Conditions